Supply Chain Optimization

Traditional, correlational, machine learning approaches often fail to improve supply chain management

We brought to market the first operating system for decision making powered by Causal AI, decisionOS, to empower enterprises to optimize their supply chain management

Traditional machine learning approaches often fail

to improve supply chain management

Spurious correlations lead to bad decisions

And are often perceived as “black boxes”

Read more on our blog:

Explainable AI doesn’t explain enough

For example, they can predict if there will be a delay in an order but can’t recommend the next best action to prevent the delay

Do these questions sound familiar?

Enterprises run on causal questions

What actions do I need to take to optimize on-time in-full levels?

What decisions are impacting my margins when analyzing my fulfillment strategy, and how can I optimize those decisions?

How will certain initiatives impact my in-store operations?

Which are the right suppliers for my components, given costs, lead times and demand levels?

How might future supply chain disruptions impact my operations, what actions should I take?

What actions should I take to reduce scheduling inefficiencies?

See this solution in practice

Interactive ExampleLicense our platform to answer these questions using Causal AI

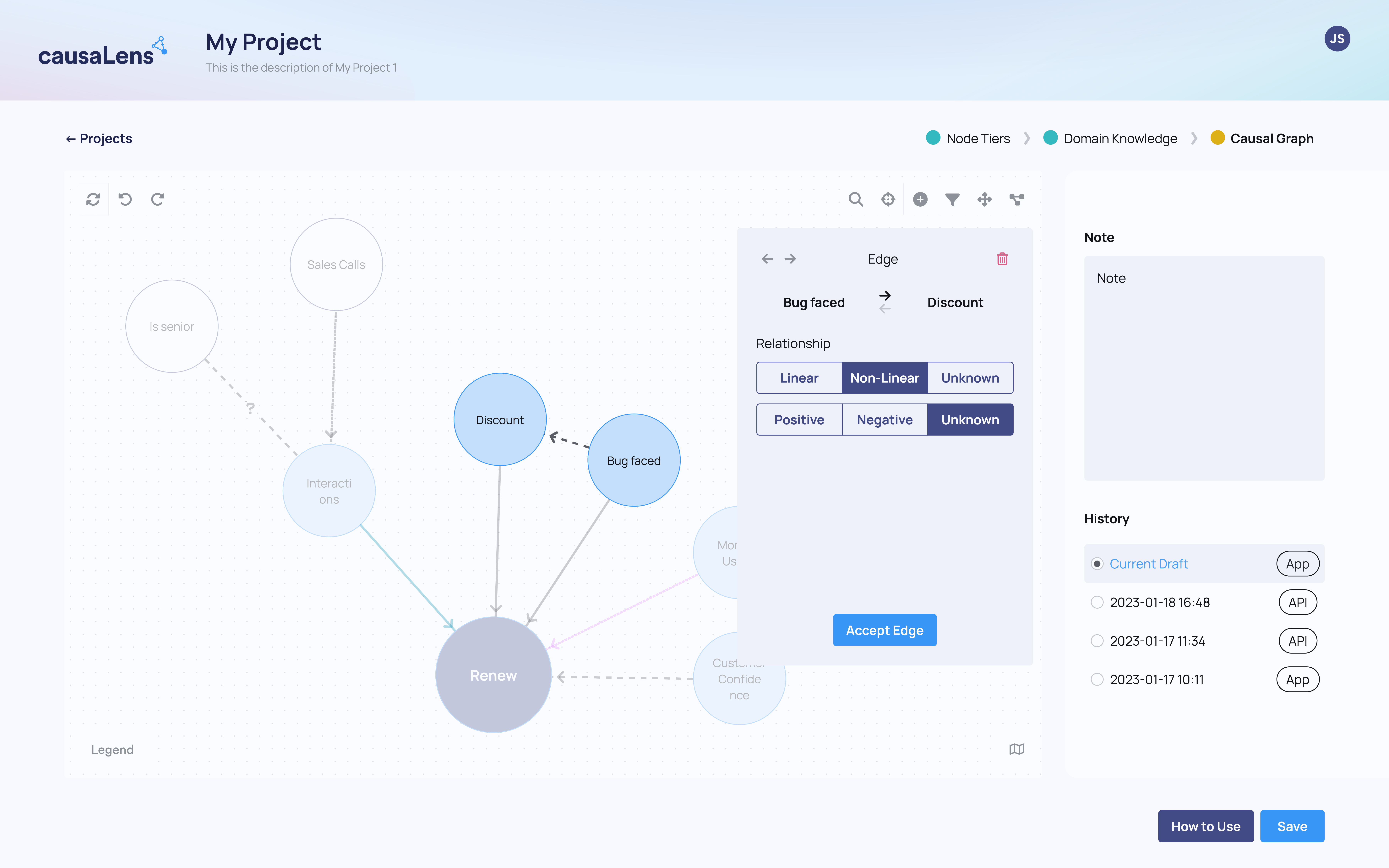

Discover cause-effect relationships within your marketing data

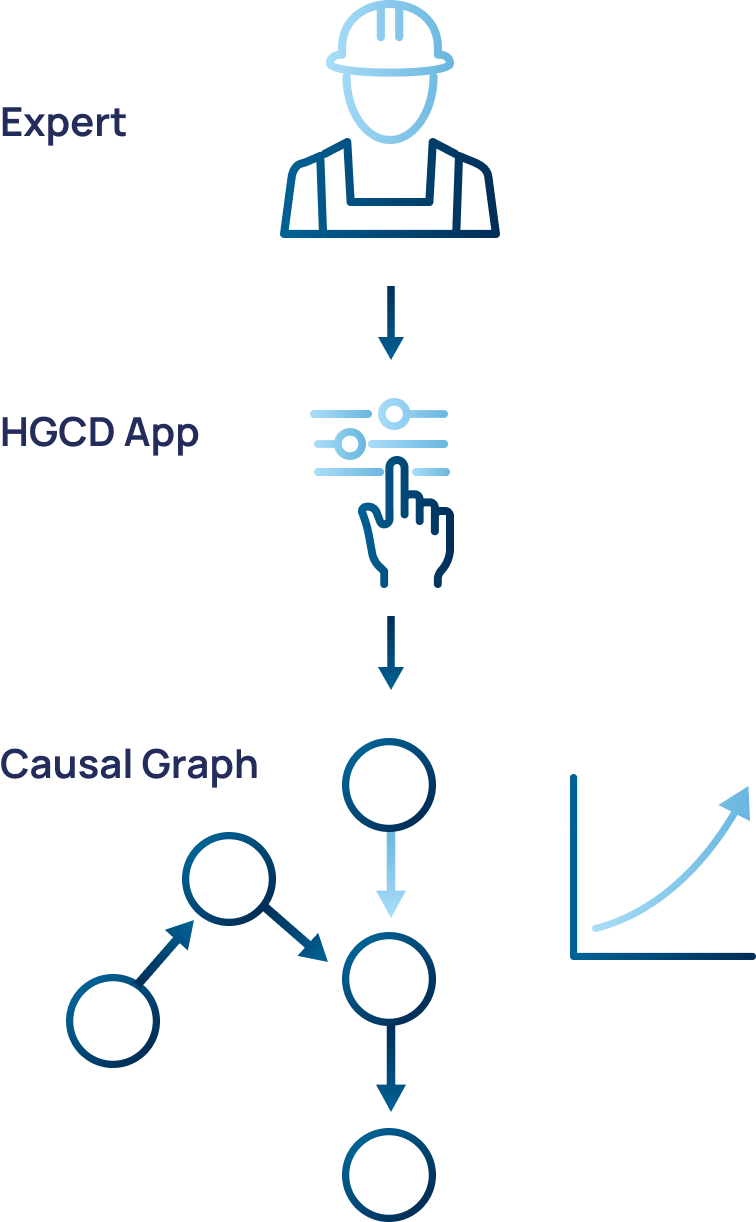

Discover cause-effect relationships in your supply chain data by combining the best of domain knowledge with data-driven, statistical, approaches

Read more

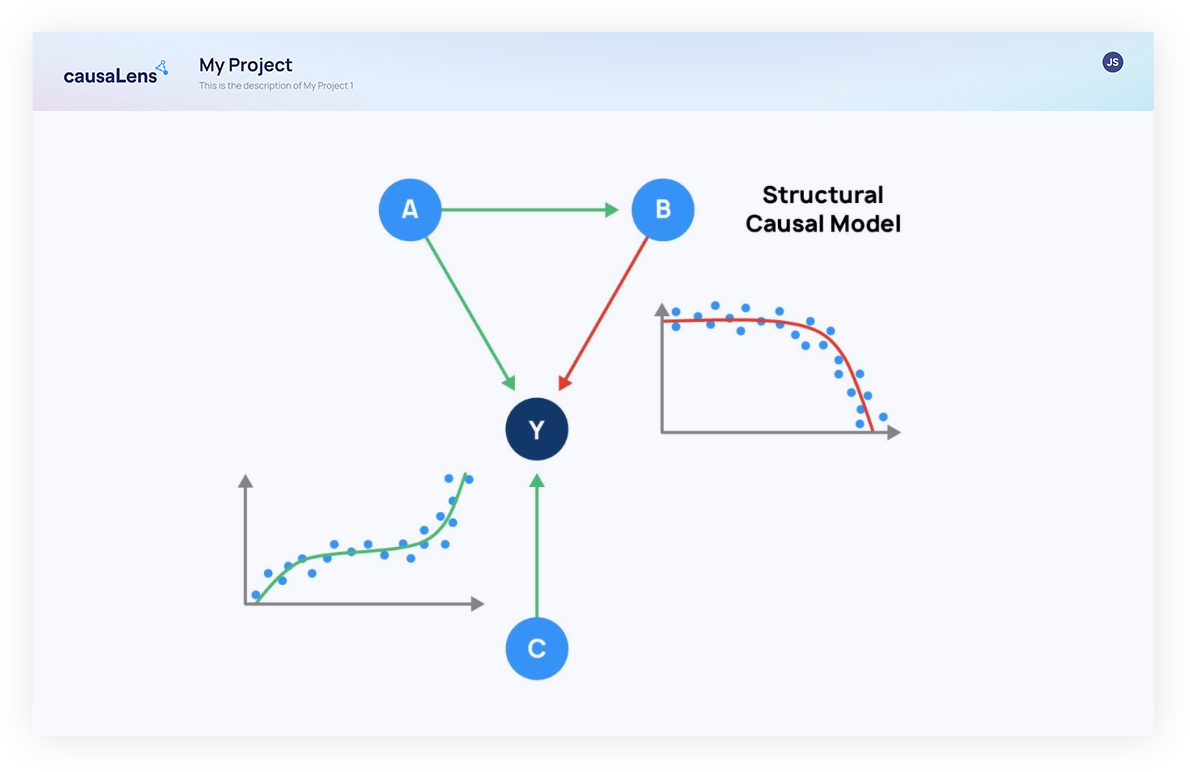

Build Causal Models

Discover causal models, based on cause-effect relationships and causal graphs, that can robustly predict estimate the effect of changes (e.g. sourcing materials from a new supplier) and allow you to run powerful what-if scenarios

Read More

Make better decisions with Decision Intelligence Engines

Leverage our pre-built engines on top of your causal models to:

Understand root causes

Automatically rank the potential root causes of delays, inefficiencies or process errors

Design next best actions

E.g Decide where you should source a materials from

Perform powerful what-if analyses and estimate counterfactual scenarios

Understand the impact of a 10% increase in demand

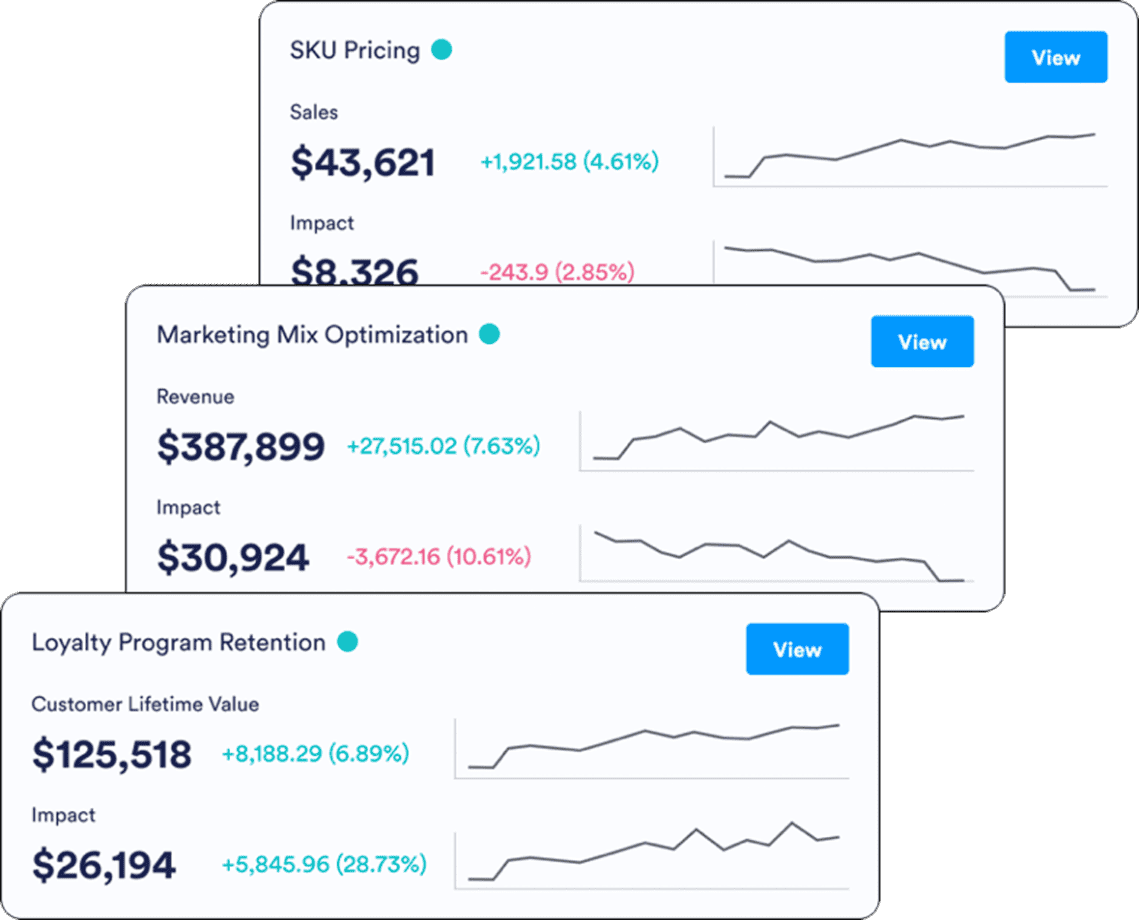

Build Decision Apps

Leverage Dara, our app building framework, to seamlessly deliver beautiful, interactive decision making applications to the supply chain & executive teams

Learn more

Monitor and optimize supply chain decisions with decisionOps

Build, deploy & monitor your decision workflows while attributing KPI performance to the appropriate actions whether that’s yours, your competitor’s actions or the macro-economic environment

Learn more

Related Case Studies

Customer Case Study: Order Delays Reduction

Textile manufacturer sees a 10% reduction in order delays by adopting Causal AI

Customer Case Study: Inventory Optimization

A leading manufacturer of IT products and equipment sees $19mn in savings from matching inventory levels to customer demand more accurately

Customer Case Study: Manufacturing Downtime Reduction

$10bn Metals Enterprise sees an expected return of $4M from maximal throughput while reducing downtime

Causal AI at BMW Group's supply chain team

Watch the presentation from the Causal AI conference 2023

Cisco's Forecasting Data Science Leader, Puneet Gupta

At the Causal AI Conference 2022

Proven value in weeks

Request your free trial now, and we’ll get you started on your Causal AI journey. Within weeks, you can answer your company’s critical business questions and drive improvement in your KPIs.

-

1Discovery Call

Understand your needs.

1 hour. -

2Platform Trial

Test drive decisionOS.

14 days. -

3Build, Deploy, Scale

Answer business-critical questions. Within weeks.

-

4Ongoing Support

World-class support from leading experts. Ongoing.