Causal Portfolio Optimization: Modern Portfolio Theory 2.0

At a glance

- Traditional portfolio optimization theories fail in the real world, because they are based on misleading correlations.

- Current machine learning approaches suffer from the same problem.

- Causal AI outperforms all other approaches in terms of risk-adjusted returns, and it is intuitive, transparent and explainable.

- Leading asset managers are benefiting from intelligent portfolio optimization with Causal AI.

Challenges in portfolio optimization

Predictions under high uncertainty. Portfolio managers need to produce reliable asset risk and return estimates. However, the current global economic outlook is highly uncertain. Divergent inflation and post-pandemic recovery scenarios are among the factors that managers need to grapple with.

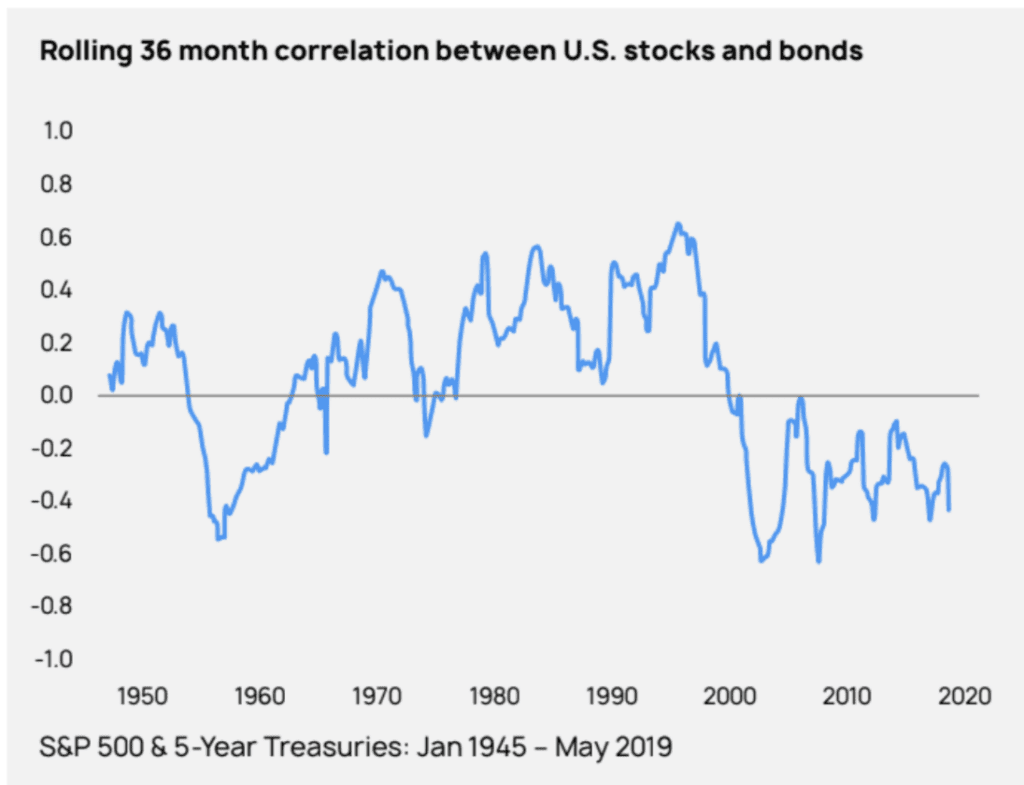

Robust diversification. Portfolio managers need to understand the relationships between assets, to mitigate concentration risk. However, long-standing intermarket correlations — notably the negative correlation between equities and bonds that’s held since the 2000s — are shifting. Failure to anticipate these shifts can result in excessive losses.

Figure. Correlations between asset classes are not stable over time

Standard approaches are flawed. Prominent approaches to portfolio optimization, such as Modern Portfolio Theory, underperform — even relative to very simple, naive ways of allocating. Troublingly, these approaches are most likely to fail during downturns, precisely when a solid portfolio is most needed. It’s an open secret that they don’t work in the real world.

Current AI approaches are limited. The majority of asset managers have adopted artificial intelligence (AI), especially machine learning (ML), for portfolio optimization. Even though ML can produce better results than traditional approaches, the current generation of algorithms have flaws. They “discover” relationships between assets that don’t really exist and they crash during periods of disruption (such as Q1 2020), when historical correlations break down.

AI has the potential to do better. It can produce more reliable asset return and risk estimates. And it can optimize portfolios to meet performance targets in complex, real-world settings.

Causal AI for intelligent portfolio optimization

Causal AI digs beneath correlations to identify causal relationships between individual securities and asset classes. Causal relationships are more meaningful than correlations: they are robust to minor perturbations in the markets; and they adapt far quicker to big shifts and new economic scenarios.

Causal AI intelligently clusters assets based on causal relationships, unearthing asset classes that are relatively causally isolated from one another. This achieves more robust and persistent diversification, without diminishing expected returns (see below for technical details).

Portfolios optimized with Causal AI are also more explainable and transparent than black-box ML models. Portfolio managers can be confident in their models, and can justify portfolio weights to investors and auditors.

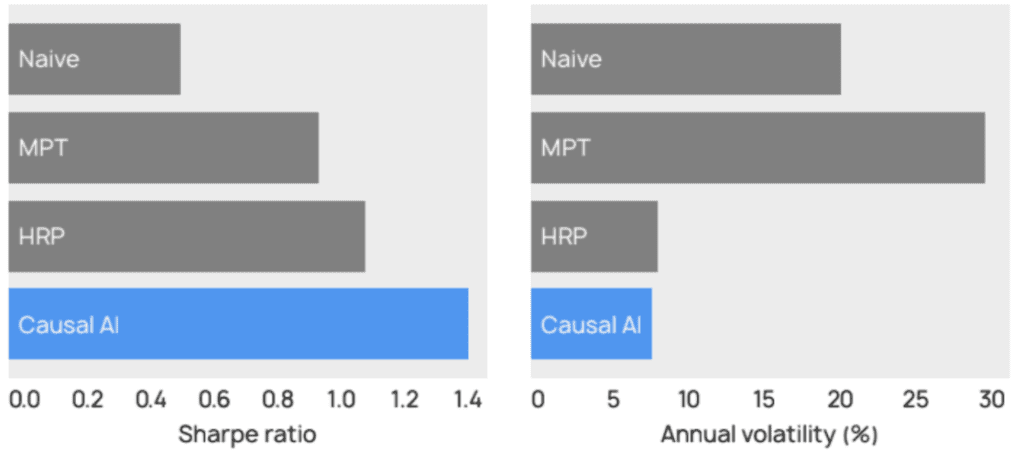

Causal AI achieves significantly lower volatility, higher returns and more moderate drawdowns than the next-best alternative, primarily because of the unique approach to diversifying across causally unrelated assets. We find this consistently in the field with clients and from extensive experimentation.

For example, we benchmarked Causal AI against traditional and ML-based optimization theories, using data from 22 ETFs during the period January 2019 to September 2020. Causal AI outperformed all other approaches in terms of risk-adjusted returns. Causal AI achieved a 19% greater Sharpe ratio than state-of-the-art ML optimization. During the downturn in Q1 2020, Causal AI had the most modest maximum drawdown, 1.2% less than the next-best alternative.

Figure. Causal AI produces superior Sharpe ratios and lower volatility than

alternative approaches. “Hierarchical Risk Parity” (“HRP”) is a prominent

optimization algorithm that uses conventional ML.

Technical: From Modern Portfolio Theory to causal Hierarchical Risk Parity

- Modern Portfolio Theory (MPT) is known to be unstable. A key source of instability is its hypersensitivity to small errors in the estimation of risk and expected returns. This oversensitivity in turn derives from MPT’s reliance on a correlation matrix, describing how every security correlates with every other security in the portfolio.

- Hierarchical Risk Parity (HRP) substitutes the correlation matrix for a graph, in which securities are hierarchically clustered into similar asset classes. The motivation is that capital markets exhibit a hierarchical structure (stocks behave differently to commodities, energy stocks behave differently to technology stocks, and so on). HRP uses ML to learn this hierarchical structure. HRP is reliant on estimating far fewer correlations than MPT and is more stable.

- Causal HRP improves on HRP by learning a causal hierarchical graph, in which clusters are based on causal relationships as opposed to correlations. The causaLens AI platform leverages cutting-edge causal discovery algorithms to identify these causal relationships. The resulting portfolio harnesses the benefits of causality, such as robustness to spurious correlations and adaptability to regime shifts.